detalugi.ru Gainers & Losers

Gainers & Losers

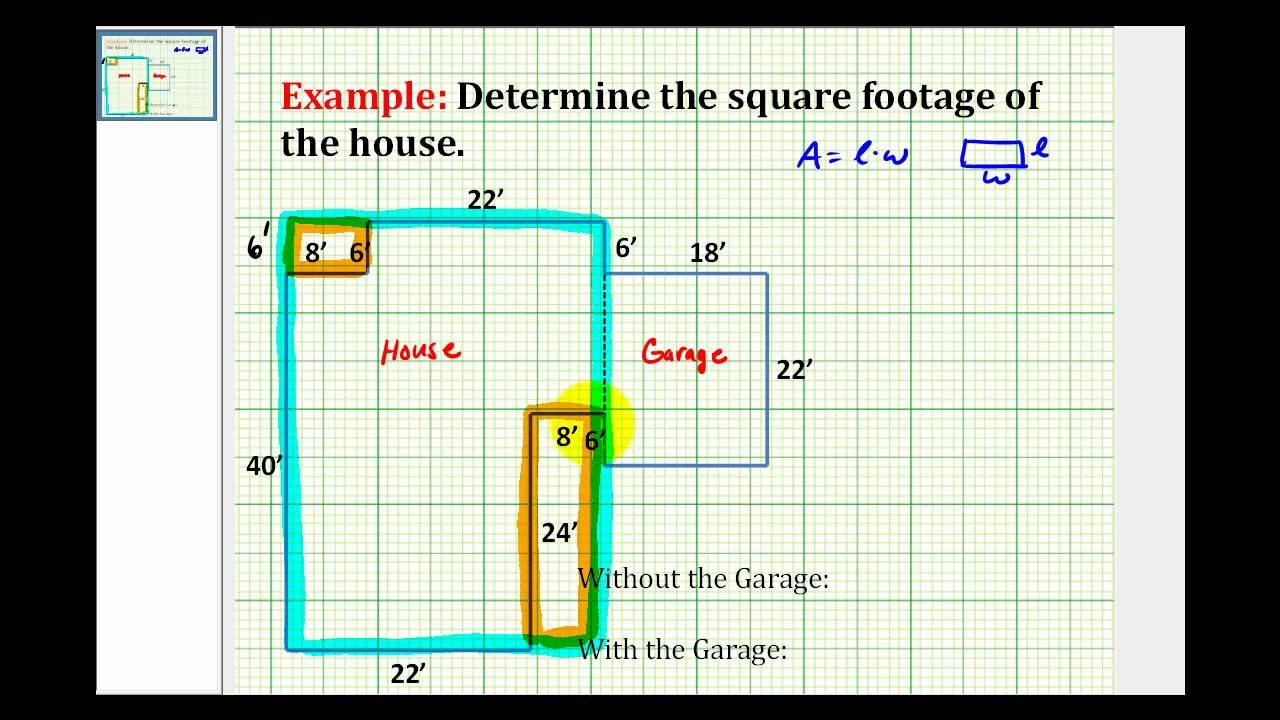

How To Determine The Square Footage

One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. Every property is different. Knowing the square footage of your yard tells you how much water, fertilizer, or grass seed you will need to maintain it. If your lot is feet deep and feet wide*, simply multiply X = a total of 13, square feet. Then subtract from this total the square footage. Steps to Calculate Square Feet · Measure the length and width of the area. · Convert these measurements to feet if they aren't already. · Multiply the length in. Measure the length in feet, Measure the width in feet. Multiply the length figure by the width figure. This will be your total square footage for that portion. BYJU'S online square footage calculator tool makes the calculation faster, and it displays the square footage in a fraction of seconds. It's easy. Follow these steps. Measure the length in feet, Measure the width in feet. Multiply the length figure by the width figure. This will be your total. When I want to know the square footage of a house, I use a computer (technically a tool, but you can also physically go to an office to get the. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. Every property is different. Knowing the square footage of your yard tells you how much water, fertilizer, or grass seed you will need to maintain it. If your lot is feet deep and feet wide*, simply multiply X = a total of 13, square feet. Then subtract from this total the square footage. Steps to Calculate Square Feet · Measure the length and width of the area. · Convert these measurements to feet if they aren't already. · Multiply the length in. Measure the length in feet, Measure the width in feet. Multiply the length figure by the width figure. This will be your total square footage for that portion. BYJU'S online square footage calculator tool makes the calculation faster, and it displays the square footage in a fraction of seconds. It's easy. Follow these steps. Measure the length in feet, Measure the width in feet. Multiply the length figure by the width figure. This will be your total. When I want to know the square footage of a house, I use a computer (technically a tool, but you can also physically go to an office to get the. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two.

Typical rules are to measure the exterior of the house, then subtract any areas that are not heated or finished, subtract areas where the ceiling height is too. The formula used to calculate square feet involves multiplying the length of an area by its width. For instance, if you have a room that is Use this square footage calculator to easily calculate the area of a rectangular room or a room with a more complex shape. The next step in how to calculate square footage is to plug your measurements into the square footage formula: L x W = A (in square feet). This free calculator estimates the square footage of a property and can account for various common lot shapes. If your lot is feet deep and feet wide*, simply multiply X = a total of 13, square feet. Then subtract from this total the square footage. Enter your desired width and length in feet. The tool will then estimate the square footage. It will also determine the waste value and then give you the total. The square footage calculation is simple. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation. Square Footage Calculator · Length (ft) x Width (ft) = Total Square Feet · x (Diameter (ft)/2)^2 = Total Square Feet · 1/2 x Length of Side 1 (ft) * Length. To get a rough estimate of the amount of square footage of flooring that you will need for that room, multiply the length of the room by the width of the room. Square measurements are calculations of area. In most general terms, it imagines a tiling of a two-dimensional space in squares of uniform size. To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. How do you calculate square feet from inches? To calculate the square footage of a space based on square inches, divide the square inches value by Square. So if your walls are 4 ft thick or 2 inches thick the square footage of the building will / should be the same. The wall thickness is simply used to determine. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply (For example, 40 feet x 30 feet = 1, square feet.) Next, multiply the area by your roof's pitch. (1, x = 1, square feet.) To allow for hips. Use our square footage calculator to help you estimate the amount of material you may need for your project. Now measure each door and window for height and width. Multiply height times width to get the square footage of each, and total all the doors and windows. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room.

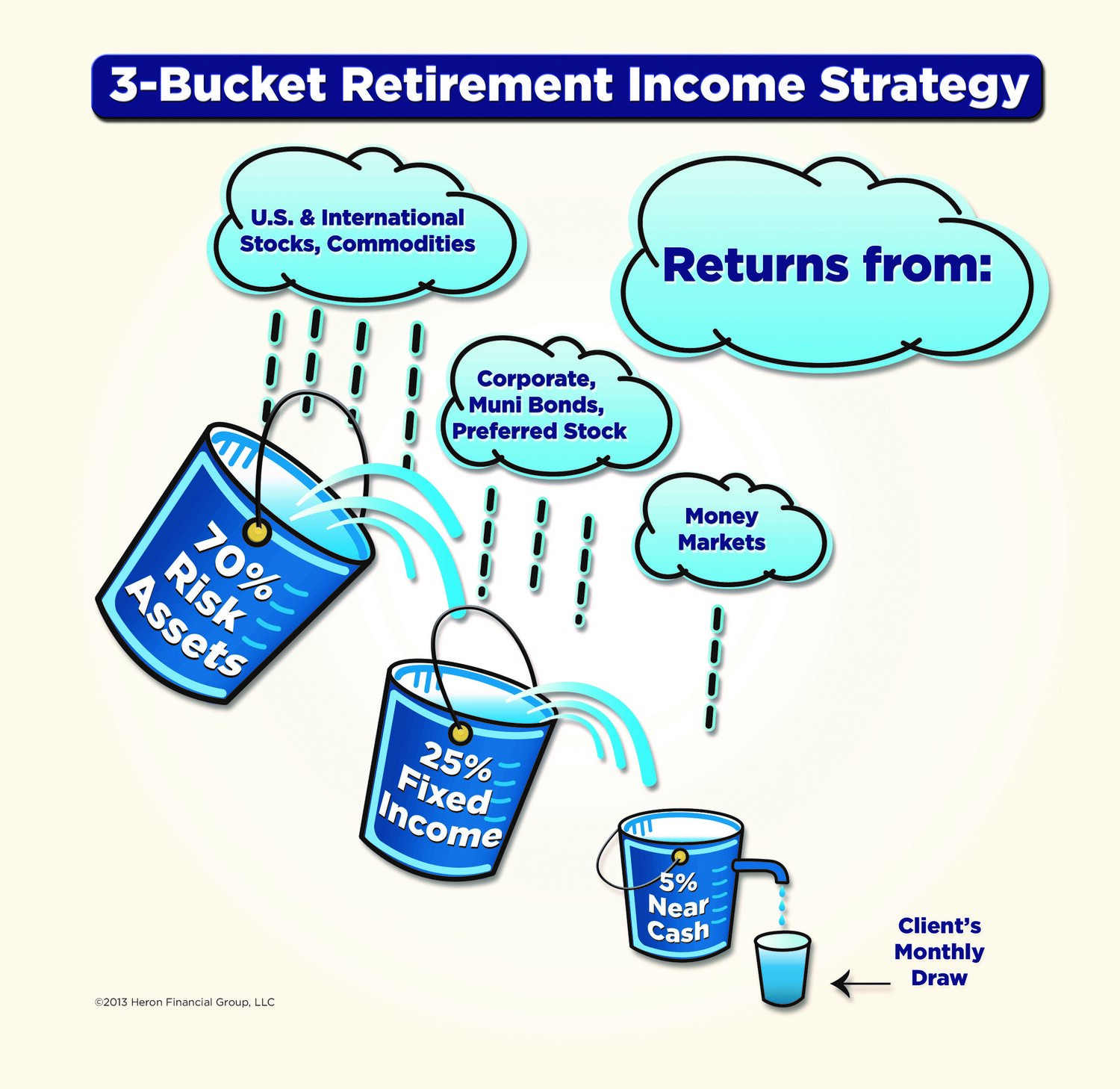

Money Market Retirement

Money Market Accounts typically have a high average minimum balance requirement. A Money Market IRA with Huntington can be started with as little as $1 with our. Whether you want to save for a specific period of time, have immediate access your funds or make your plans for retirement, we can help you choose the account. With a Retirement Money Market account, you can diversify your retirement portfolio with a tax advantage. This account requires an individual retirement. Open a Money Market Account with tiered interest and more competitive rates than traditional savings accounts. It provides the power of an FDIC-insured. Retirement Money Market pricing and features · No monthly maintenance fee · Minimum opening deposit · Competitive interest rates. Build your retirement savings. money market detalugi.ruck, jump to top of page. Explore our services. Checking Accounts · Savings Accounts · Credit Cards · Loans · Mortgages · Investing &. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Our IRA Money Market offers guaranteed returns, competitive earnings, and tax benefits to help your savings go even further. Money market funds generally pay a higher yield than traditional bank savings accounts. And it's easy to withdraw money from a money market fund without the. Money Market Accounts typically have a high average minimum balance requirement. A Money Market IRA with Huntington can be started with as little as $1 with our. Whether you want to save for a specific period of time, have immediate access your funds or make your plans for retirement, we can help you choose the account. With a Retirement Money Market account, you can diversify your retirement portfolio with a tax advantage. This account requires an individual retirement. Open a Money Market Account with tiered interest and more competitive rates than traditional savings accounts. It provides the power of an FDIC-insured. Retirement Money Market pricing and features · No monthly maintenance fee · Minimum opening deposit · Competitive interest rates. Build your retirement savings. money market detalugi.ruck, jump to top of page. Explore our services. Checking Accounts · Savings Accounts · Credit Cards · Loans · Mortgages · Investing &. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Our IRA Money Market offers guaranteed returns, competitive earnings, and tax benefits to help your savings go even further. Money market funds generally pay a higher yield than traditional bank savings accounts. And it's easy to withdraw money from a money market fund without the.

A retirement money market account may be held within a Roth IRA, traditional IRA, rollover IRA, (k) or other retirement account. Unlike a regular money. Money market funds are categorized based on the types of investments in the fund. Fidelity offers government, prime, and municipal (or tax-exempt) money market. The Fund invests at least % of its total assets in government securities, cash and repurchase agreements collateralized fully by government securities or. money market mutual funds (money market funds) and bank deposit solutions designed to provide liquidity, relative safety, and yields for your cash holdings. Save for retirement with Navy Federal IRA money market savings accounts. See the best rates for money market accounts and start saving today. IRA Money Market Savings Account. A money market IRA allows you to take advantage of higher dividends in exchange for a minimum balance of $2, or more. Looking to lock in a guaranteed return for the term of your IRA CD? IRAs from Bank of America are FDIC insured and offer interest-bearing CD or money market. Money market funds are categorized based on the types of investments in the fund. Fidelity offers government, prime, and municipal (or tax-exempt) money market. High-yield savings accounts. While some of your money should be in the stock market, it's also good to have more on hand in a savings account that's easily. Their values change frequently. There can be no assurances that a money market fund will be able to maintain its net asset value per unit at a constant amount. A Roth IRA is a retirement account to invest and save money. As long as your money stays in a Roth IRA, you don't owe income tax on your investment gains and. Investment options for how you want to save · Your investment Options · Target Retirement Funds · Environmental, Social, Governance Fund · Core Bond Fund · Global. A retirement money market account may be held within a Roth IRA, traditional IRA, rollover IRA, (k) or other retirement account. Unlike a regular money. Among taxable money market funds Retail funds are sold primarily to the general public and include funds sold predominantly to employer-sponsored retirement. A money market fund is a type of fixed-income mutual fund that invests in highly liquid, short-term, low-risk securities. "Most funds allow you to access your. A target-date fund is a long-term investment account that is adjusted over time to reduce risk as the investor approaches a specific goal such as retirement. Retirement Share class - $3 each month the balance is below $1, · Investment Share class - $3 each month the balance is below $2, There is no minimum. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of The Fund invests in high. A money market fund is a type of mutual fund that has relatively low risks compared to other mutual funds and most other investments and historically has. A money market IRA allows you to take advantage of higher dividends in exchange for a minimum balance of $2, or more. Rates apply to the entire balance.

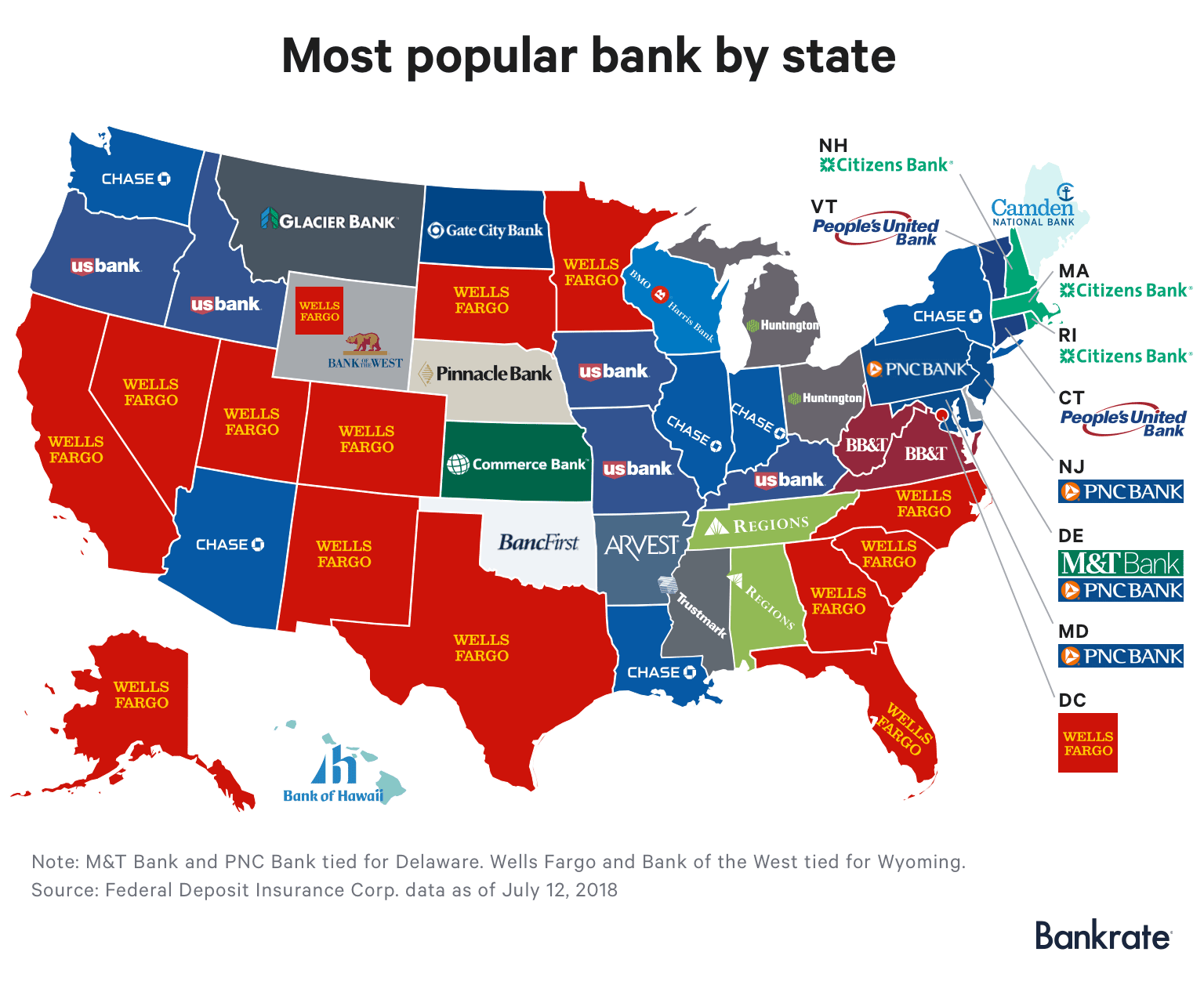

Top Rated Us Banks

Top 50 Banks in the World ; 5, 6, JPMorgan Chase Bank National Association ; 6, 5, BNP Paribas SA ; 7, 7, China Development Bank ; 8, 10, Bank of America National. I'm thinking about opening an account with a different US bank. There are the obvious: Bank of America, CitiBank, WellsFargo. Do you suggest these national. Top 10 biggest US banks by assets in Data drop · 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. Find resources for bankers. Get answers to banking questions. Join one of the best places to work. Visit the official website of the OCC. List of largest banks in the United States ; 3, Citigroup · New York City ; 4, Wells Fargo · San Francisco, California ; 5, Goldman Sachs · New York City ; 6. The best savings account rates from our partners for August 22, · American Express image. Savings Account. American Express. Member FDIC. APY. %. Alliant Credit Union · Ally Bank · America First Federal Credit Union · American Express National Bank · Armed Forces Bank · Associated Bank · Axos Bank · Bank of. Recent Reviews ; Great Experience 5 stars - Newtek Bank, Gamer 23 hours ago ; False Information 1 stars - American Bank, National Association (TX), ricsue The five largest banks in America are JPMorgan Chase, Bank of America, Wells Fargo, Citibank and U.S. Bank. · Those five banks have combined assets of more than. Top 50 Banks in the World ; 5, 6, JPMorgan Chase Bank National Association ; 6, 5, BNP Paribas SA ; 7, 7, China Development Bank ; 8, 10, Bank of America National. I'm thinking about opening an account with a different US bank. There are the obvious: Bank of America, CitiBank, WellsFargo. Do you suggest these national. Top 10 biggest US banks by assets in Data drop · 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. Find resources for bankers. Get answers to banking questions. Join one of the best places to work. Visit the official website of the OCC. List of largest banks in the United States ; 3, Citigroup · New York City ; 4, Wells Fargo · San Francisco, California ; 5, Goldman Sachs · New York City ; 6. The best savings account rates from our partners for August 22, · American Express image. Savings Account. American Express. Member FDIC. APY. %. Alliant Credit Union · Ally Bank · America First Federal Credit Union · American Express National Bank · Armed Forces Bank · Associated Bank · Axos Bank · Bank of. Recent Reviews ; Great Experience 5 stars - Newtek Bank, Gamer 23 hours ago ; False Information 1 stars - American Bank, National Association (TX), ricsue The five largest banks in America are JPMorgan Chase, Bank of America, Wells Fargo, Citibank and U.S. Bank. · Those five banks have combined assets of more than.

Best banks in America · Ally Bank · Capital One · TD Bank · PNC · Axos Bank · EverBank · USAA Federal Savings Bank. The best national banks in the Bay Area · Bank of America. Best of the Bay Winner. One of the leading national banks in the Bay Area is Bank of America, and it. 9 Best National Banks in America · 1. Chase Bank · 2. Citi · 3. U.S. Bank · 4. Discover® Bank · 5. PNC Bank · 6. Bank of America · 7. TD Bank · 8. Wells Fargo. Top 10 biggest US banks by assets in Data drop · 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. List of largest banks in the United States ; 3, Citigroup · New York City ; 4, Wells Fargo · San Francisco, California ; 5, Goldman Sachs · New York City ; 6. U.S. News editors review the top banks. Find deposit product details, account and fee information and bank details for dozens of great banks. Institution has failed or is operating under regulatory conservatorship. Financial data is compiled for U.S. banks and thrifts from call report data as reported. People; Product; Insights. Contact Us · Subscribe. Contents. 00Back to Top; 01Insights; 02Bank Ratings by Country; 03Upcoming Events; 04Past Webinars; We want to thank our customers for ranking us as one of Forbes World's Best Banks in Enjoy top-rated banking anytime, anywhere with a range of. Join one of the best banks in Connecticut, and the only bank you'll ever need. Get personal and business banking: checking, savings, loans and more! 1 Chase ; 2 Capital One Bank ; 3 Wells Fargo ; 4 Citibank ; 5 Bank of America. Today's banks paying the highest savings account rates are Poppy Bank at % AP, Flagstar Bank at % APY, and Western Alliance Bank at % APY. The 7 best banks for non-residents in the U.S. · SoFi® · HSBC · Chase · Capital One · Bank of America · Wells Fargo · Charles Schwab. Banks for foreigners. West Plains Bank and Trust in Missouri, No. 11 on this year's Best Banks to Work For ranking, wins high marks for constructive training, employee development. Looking for the best bank or credit union? Consumer Reports has honest ratings Contact Us · Account Settings · About Membership · Submit a News Tip. Company. Wells Fargo is one of the largest banks in the U.S., serving one in three American households. Here are some useful things to know about Wells Fargo: /5. The bank also offers a highly rated cash-back checking account. Read full Capital One Bank is among the 10 largest U.S. banks by assets. While it. Industrial and Commercial Bank of China Ltd., with assets of $ trillion, retained its place as the world's biggest bank as the Chinese megabanks occupied. Browse the Vault Banking 25 to find the best investment banks to work for. Vault's banking rankings are a trusted source for insider info on investment. 5. Bank of America: Best for Full-Service Banking · Fees: No fees as long as you're under 25 · Minimum Deposit: $25 for SafeBalance and $ for Advantage Plus.

80 Carbs A Day Diet

While there is no strict definition of a low carb diet, anything under – grams per day is generally considered low carb. This is definitely a lot less. ketogenic diet (KD) – usually less than 50 grams of carbohydrates per day (assuming total intake of 2, calories). very low-calorie ketogenic diet. If you eat 80g of carbs a day, your body will still produce some carbs via gluconeogenesis, but probably not up to the full requirement. Then. For example, a week on CKD would involve eating grams of carbs for five consecutive days, then eating a high-carb diet (over grams per day) for two. 80g cooked or 1⁄2 uncooked medium potato or sweet potato. 1 thin slice A lower-carb diet is roughly defined as day of carbohydrate. When. Carbs (g). Bread. 1 slice. Cornbread. 1 piece (deck of cards). 30 Carbohydrates Food List. - 2 -. Potato, mashed. ½ cup. Sweet potato/yams. 1. You can eat 50 to 80 Net Carbs daily. Once you reach your ideal weight, you continue to eat a predominantly low-carbohydrate ( Net Carbs per day) diet. The sweet spot seems to be around grams a day – it's not too strict but strict enough to get good results. The point is, when following a low carb diet. In a low-carb diet, you restrict calories from carbs to about per day. This means you limit your carb intake to ounces ( grams). While there is no strict definition of a low carb diet, anything under – grams per day is generally considered low carb. This is definitely a lot less. ketogenic diet (KD) – usually less than 50 grams of carbohydrates per day (assuming total intake of 2, calories). very low-calorie ketogenic diet. If you eat 80g of carbs a day, your body will still produce some carbs via gluconeogenesis, but probably not up to the full requirement. Then. For example, a week on CKD would involve eating grams of carbs for five consecutive days, then eating a high-carb diet (over grams per day) for two. 80g cooked or 1⁄2 uncooked medium potato or sweet potato. 1 thin slice A lower-carb diet is roughly defined as day of carbohydrate. When. Carbs (g). Bread. 1 slice. Cornbread. 1 piece (deck of cards). 30 Carbohydrates Food List. - 2 -. Potato, mashed. ½ cup. Sweet potato/yams. 1. You can eat 50 to 80 Net Carbs daily. Once you reach your ideal weight, you continue to eat a predominantly low-carbohydrate ( Net Carbs per day) diet. The sweet spot seems to be around grams a day – it's not too strict but strict enough to get good results. The point is, when following a low carb diet. In a low-carb diet, you restrict calories from carbs to about per day. This means you limit your carb intake to ounces ( grams).

To stay in ketosis, a person requires up to 50 grams (g) of carbs per day. A person following a keto diet eats foods with high levels of fats and very low. If you stick to complex carbs like these instead of eating mostly refined carbs day. null. If you enjoy sugary carbs and don't want to remove them. Day 3. cal, 81g protein, 80g net carbs, 40g fat, 13g fiber. Breakfast. Easy mini quiche. 1 quiche(s) (96cal, 6p, 5c, 5f). Milk. 1/2 cup. diets like ketogenic or paleo diets, which limit carbs and processed foods. Following the 80/20 rule daily means you have wiggle room to splurge every day. A daily limit of to 2 ounces (20 to 57 grams) of carbohydrates is typical with a low-carb diet. These amounts of carbohydrates provide 80 to calories. During its strict induction phase, you can only consume about 20 grams—or 80 calories—of carbohydrates per day. For a 2,calorie-a-day diet, that's only 5. Although carbohydrates are not essential nutrients, and there are many fad diets that highly restrict or even eliminate carb intake, there are benefits to. Grams of Carbs per Day for Prediabetics · Under 20 to 50 grams of carbohydrates per day: very low-carb ketogenic diet. · grams: "Adequate Intake" (the amount. General recommendations for a healthy diet are to get between 45 % of your daily calories from carbohydrates. Thus, for a typical calorie per day diet. Eating a low-carb diet means cutting down on the amount of carbohydrates (carbs) you eat to less than g a day. But low-carb eating shouldn't be no-carb. Atkins ™ is a lifestyle approach, and you'll begin the program by eating grams of net carbs a day split between three meals and two snacks. As long as. Jul 14, - Explore Carly Jo's board "UNDER 80 G CARBS" on Pinterest. See more ideas Atkins Diet, Low Carb Snack Ideas, Resep Diet Sehat, Low Carb Snack. Just one large potato contains 20 grams of net carbs, the daily limit on a keto low-carb diet. As does one half of a large hamburger bun. Or half a cup of rice. 80%, though with only a moderate intake of protein. How It The ketogenic diet typically reduces total carbohydrate intake to less than 50 grams a day. For Optimal Long-Term Results: Aim For g Carbs Per Day If you focus on eating the right types of carbohydrates, then you won't really have to focus on. Carbs (g). Bread. 1 slice. Cornbread. 1 piece (deck of cards). 30 Carbohydrates Food List. - 2 -. Potato, mashed. ½ cup. Sweet potato/yams. 1. What should I eat? That's likely the #1 question from people going low carb. We make low carb simple, and this low-carb diet plan gives you a full day. Adapted from Academy of Nutrition and Dietetics, These sample menus provide ~ calories and grams protein per day. Day 1. Day 2. Day 3. Day 4. For someone eating 2, calories a day, this would be about g to g of carbs per day. Carbs make up the largest percentage of calories from the three.

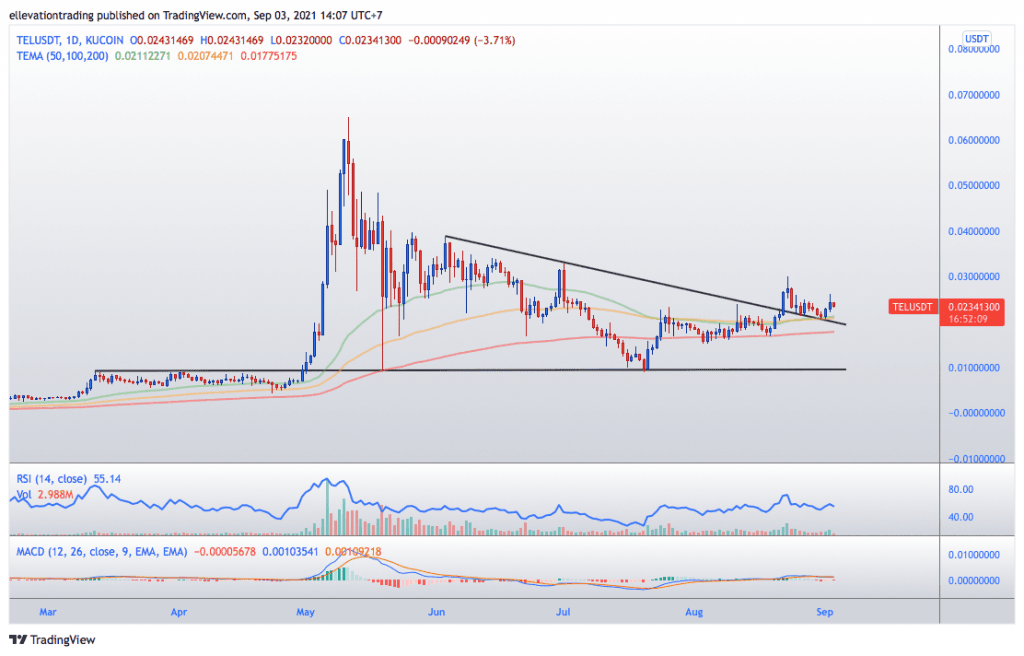

Telcoin Price

View Telcoin (TEL) cryptocurrency prices and market charts. Stay informed on how much Telcoin is worth and evaluate current and historical price. Free access to the latest Telcoin prices with detalugi.ru TEL price charts, historical data and currency converter in one place! The price of Telcoin (TEL) is $ today with a hour trading volume of $, This represents a % price increase in the last. August 19, - Discover the latest Telcoin USD price with real-time charts, market cap, and news. Learn about current trading trends and historical data. Email & SMS crypto price alerts for Telcoin (TEL) and other coins and tokens. TEL price now: BTC | USD. The current price of Telcoin is $ Discover TEL price trends, charts & history with Kraken, the secure crypto exchange. Telcoin USD Price Today - discover how much 1 TEL is worth in USD with converter, price chart, market cap, trade volume, historical data and more. TEL Markets ; USDT price logo. TEL/ USDT · LBank. $, $ %. $ % ; USDT price logo. TEL/ USDT · Bitrue. $ The live price of Telcoin is $ per (TEL / USD) with a current market cap of $ M USD. hour trading volume is $ , USD. TEL to USD price. View Telcoin (TEL) cryptocurrency prices and market charts. Stay informed on how much Telcoin is worth and evaluate current and historical price. Free access to the latest Telcoin prices with detalugi.ru TEL price charts, historical data and currency converter in one place! The price of Telcoin (TEL) is $ today with a hour trading volume of $, This represents a % price increase in the last. August 19, - Discover the latest Telcoin USD price with real-time charts, market cap, and news. Learn about current trading trends and historical data. Email & SMS crypto price alerts for Telcoin (TEL) and other coins and tokens. TEL price now: BTC | USD. The current price of Telcoin is $ Discover TEL price trends, charts & history with Kraken, the secure crypto exchange. Telcoin USD Price Today - discover how much 1 TEL is worth in USD with converter, price chart, market cap, trade volume, historical data and more. TEL Markets ; USDT price logo. TEL/ USDT · LBank. $, $ %. $ % ; USDT price logo. TEL/ USDT · Bitrue. $ The live price of Telcoin is $ per (TEL / USD) with a current market cap of $ M USD. hour trading volume is $ , USD. TEL to USD price.

Discover historical prices for TEL-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Telcoin USD stock was issued. In depth view into Telcoin Price including historical data from to , charts and stats. Telcoin (TEL) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. Price of Telcoin (TEL) today As of the latest data, Telcoin (TEL) is currently priced at $ with a market capitalization of $M. The hour trading. The current price of Telcoin (TEL) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what. The Telcoin price is currently at $, as of August 26, Over the past 24 hours, the price of TEL has moved by %. The hour trading volume. 【TEL ➦ USD Converter】➤➤➤ 1 Telcoin to US Dollar price calculator ✓ convert cryptocurrency online ✓ today exchange rates on ⏩ detalugi.ru Our real-time TEL to USD price update shows the current Telcoin price as $ USD. According to our Telcoin price prediction, TEL price is expected to. Telcoin (TEL) coin live price, Telcoin coin history, graph market cap and supply by CoinSpot - Australia's most trusted cryptocurrency exchange since The current Telcoin price is €. The price has changed by % in the past 24 hours on trading volume of €. The market rank of Telcoin is. Telcoin price today is $ with a hour trading volume of $ ,, market cap of $ M, and market dominance of %. The TEL price increased. The live price of Telcoin is $, with a total trading volume of $ 59, in the last 24 hours. The price of Telcoin changed by +% in the past day. TEL to INR Chart. Telcoin (TEL) is worth ₹ today, which is a % increase from an hour ago and a % increase since yesterday. The value of TEL today is. Telcoin TEL price graph info 24 hours, 7 day, 1 month, 3 month, 6 month, 1 year. Prices denoted in BTC, USD, EUR, CNY, RUR, GBP. Live Telcoin (TEL) price index, charts, marketcap, and news. Click here for the latest Telcoin market trends from The Block. Telcoin provides low-cost, high-quality financial products for every mobile phone user in the world. - The current TEL price is per (TEL/USD). Telcoin is % rise the all time high of $ The current circulating supply is. 28 August - The Telcoin price today is USD. View TEL-USD rate in real-time, live Telcoin chart, market cap and latest Telcoin News. Telcoin is falling this week. The current price of Telcoin is $ per TEL. With a circulating supply of 90,,, TEL, it means that Telcoin has a. Telcoin Telcoin is a form of digital cryptocurrency, also referred to as TEL Coin. Use this page to follow the Telcoin price live, cryptocurrency news.

Average Closing Cost For Refinancing Mortgage

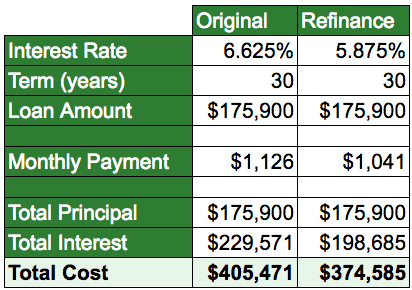

Closing costs typically equal about 1 to 4% of your loan amount. For example, if your loan amount is $,, your closing costs could range from $2, to. Choose Your ZERO Closing Cost Rate ; Monthly Payment, $2,, $2, ; Traditional Closing Costs, $0, $3, ; Prepaids, Escrows & Government Taxes, $0, $ ; Paid. If you're talking about one-time fees, somewhere in the % range of the amount of the loan, depending on a variety of factors like the value. Yes, just like your original mortgage, your refinance mortgage will come with closing costs. Do some research on prevailing interest rates and average. You should plan on paying an average of 3 to 6 percent of the outstanding principal in refinancing costs, plus any prepayment penalties and the costs of paying. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about % of your loan amount and are. Typically, during a “no-closing-costs” refinance, the closing costs are simply folded into your principal payment. Sometimes a lender will recoup their closing. Closing costs are one of the factors that determine the money you will get from a cash-out refinance. They are usually 3% to 5% of the new loan amount. What are the typical closing costs on a refinance? When you refinance your mortgage loan, the closing costs can equate to approximately 2% to 5% of your. Closing costs typically equal about 1 to 4% of your loan amount. For example, if your loan amount is $,, your closing costs could range from $2, to. Choose Your ZERO Closing Cost Rate ; Monthly Payment, $2,, $2, ; Traditional Closing Costs, $0, $3, ; Prepaids, Escrows & Government Taxes, $0, $ ; Paid. If you're talking about one-time fees, somewhere in the % range of the amount of the loan, depending on a variety of factors like the value. Yes, just like your original mortgage, your refinance mortgage will come with closing costs. Do some research on prevailing interest rates and average. You should plan on paying an average of 3 to 6 percent of the outstanding principal in refinancing costs, plus any prepayment penalties and the costs of paying. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about % of your loan amount and are. Typically, during a “no-closing-costs” refinance, the closing costs are simply folded into your principal payment. Sometimes a lender will recoup their closing. Closing costs are one of the factors that determine the money you will get from a cash-out refinance. They are usually 3% to 5% of the new loan amount. What are the typical closing costs on a refinance? When you refinance your mortgage loan, the closing costs can equate to approximately 2% to 5% of your.

The average cost to refinance a mortgage in the United States typically ranges from 2% to 6% of your loan amount. Today, the closing costs on a home refinance average $5, (Opens in a new Window), according to The Federal Home Loan Mortgage Corporation, a government-. FHA loan closing costs: According to the U.S. Department of Housing and Urban Development, FHA loan closing costs average between 3% and 4% of the purchase. Keep in mind: After the loan closes, the property may be reassessed, and the value could increase along with the real estate tax. Escrow amounts may also need. Typically, during a “no-closing-costs” refinance, the closing costs are simply folded into your principal payment. Sometimes a lender will recoup their closing. Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of dollars — they're typically 2 to 5% of your. The cost to refinance a mortgage in California will vary from application to application, but generally speaking, you should anticipate paying $2, to $4, Your total estimated refinancing costs will be: $6, · Loan Info · Choose a term length · Taxes & Insurance · Origination Fees · Other Settlement Services. I know fees vary by lender, but i read thst closing costs can range from 3% to 5%. Is that an accurate figure? Thanks. It varies by lender, but the overall cost ends up being about two to six percent of your loan amount. So, if you're taking out a $, loan, you may be. Expect to pay 2% to 5% of the new mortgage amount in closing costs when you refinance your mortgage. If you have sufficient equity in your home and you're. Refinance closing costs usually range from 2% to 5% of the refinance principal. For example, if you are refinancing your mortgage for $,, closing costs. Typical Refinance Closing Costs · Origination fees · Appraisal fees · Title insurance · Title search fees · Survey costs · Credit report and application fees. According to recent reports, the average closing costs for a refinance is over $4, The term “closing costs” refers to a number of fees that are part of the. Your total estimated refinancing costs will be: $2, · Loan info · Taxes & insurance · Origination fees · Other settlement charges. Closing costs are usually between $ and $1, How to lower the cost of refinancing. Negotiate fees: Ask your lender to lower or waive certain closing costs. Typical closing costs, the amount you pay when you finalize the loan, will range from $ to $, but every transaction is different. The costs of a. closing-cost refinance loan can be a smart option. Even with the higher interest rate, the fact that you're paying your loan off faster may mean that you'll. You should plan on paying an average of 3 to 6 percent of the outstanding principal in refinancing costs, plus any prepayment penalties and the costs of paying. To begin with, refinancing loans have closing costs just like a regular mortgage. The mortgage lender Freddie Mac suggests budgeting about $5, for closing.

Subscription Revenue Management Software

Glassfy · Qonversion · madduck · Paddle · Adapty · Recurly · Purchasely · RevenueCat. Recurring revenue is revenue a company expects to receive on a consistent, predictable basis. Examples of recurring revenue include long-term contracts. Recurly is the best subscription management software and recurring billing platform on the market, compatible with leading ERP, CRM, payment gateways. Subscription management software, also called subscription billing or recurring billing software, automates the billing cycle for subscription revenue models. Revenue Management for Subscription and Consumption-Based Revenue Recognition. subscription software sales. Asc Complying with ASC Our ASC CONTROL FINANCIALS. SAVE TIME. BE HAPPY. Simplified program fee revenue management for cable networks and broadcasters. Better control content programming fees. Chargebee's subscription management software allows you to seamlessly automate pricing experiments, manage recurring payments, and discover new revenue. Recurly is a subscription commerce platform, helping businesses use a subscription model and manage recurring revenue. Businesses using Recurly can create and. Oracle Subscription Management is an end-to-end solution that helps you track and manage usage, recurring charges, adjustments, and renewals across sales. Glassfy · Qonversion · madduck · Paddle · Adapty · Recurly · Purchasely · RevenueCat. Recurring revenue is revenue a company expects to receive on a consistent, predictable basis. Examples of recurring revenue include long-term contracts. Recurly is the best subscription management software and recurring billing platform on the market, compatible with leading ERP, CRM, payment gateways. Subscription management software, also called subscription billing or recurring billing software, automates the billing cycle for subscription revenue models. Revenue Management for Subscription and Consumption-Based Revenue Recognition. subscription software sales. Asc Complying with ASC Our ASC CONTROL FINANCIALS. SAVE TIME. BE HAPPY. Simplified program fee revenue management for cable networks and broadcasters. Better control content programming fees. Chargebee's subscription management software allows you to seamlessly automate pricing experiments, manage recurring payments, and discover new revenue. Recurly is a subscription commerce platform, helping businesses use a subscription model and manage recurring revenue. Businesses using Recurly can create and. Oracle Subscription Management is an end-to-end solution that helps you track and manage usage, recurring charges, adjustments, and renewals across sales.

Simplify Subscriptions, Power Growth! AI-powered subscription management platform to automate billing, optimize payments, streamline revenue management, and. Find the top Subscription and Recurring Billing Management Solutions with Gartner. Compare and filter by verified product reviews and choose the software. Subscription management is the process of managing your customers' subscriptions and making sure that their experience with your product or service is a happy. A predictable flow of subscription revenue with agility and relevance · Cloud deployment · Flexible and agile monetization tools · Support for subscription, usage. Subscription Management Software · Stax Bill · ChargeOver · detalugi.ru · Chargebee · Zenskar · Odoo · Stripe Billing · Cloudmore. Subscription Management Software stands at the core of modern business strategies, essential for any entity looking to leverage the recurring revenue model. BillingPlatform's revenue management software integrates accounting and billing data to streamline the financial close process. Unlock hyper-growth with Chargebee's Software-as-a-Service Thousands of subscription businesses trust Chargebee's unique Revenue Growth Management platform. What is a hotel revenue management system (RMS)?. A revenue management system is a comprehensive tool designed to help hotels manage various revenue tasks. Find the top Revenue Management software of on Capterra. Based on millions of verified user reviews - compare and filter for whats important to you to. Subscription management is a type of software that helps companies track and manage all activities related to their subscription offerings. Explore subscription. Revenue management software. Manage subscriptions and recurring revenue. Flexibly manage one-off and repeat business with no constraints. When entering a deal. OneBill is a transformative subscription billing, recurring billing, usage-based billing, and end-to-end revenue management platform that powers the entire. A subscription management system provides management tools to support businesses that operate on a subscription-based business model. Subscription management. Your recurring revenue business needs complete subscription management and retention solution that maximizes customer lifetime value, increases conversions. We offer an advanced billing platform for comprehensive billing and revenue management solutions. Streamline your billing processes and drive growth today. SOFTRAX RMS has functionality to handle the complexities of subscription billing and integrate billing with complex revenue recognition and contract functions. Compliance, financial reporting and subscription billing all in one scalable solution. The #1 subscription revenue management software to help you improve quote. Grow and scale your subscription revenue stream. The right subscription management solution provides everything you need to put your focus where it should be. Streamline your revenue lifecycle management and drive efficient revenue growth & optimization with end-to-end revenue management software.

Annual Car Insurance Premiums By Age

Another myth is that older drivers always pay less for insurance. While age can lead to lower rates, this isn't a hard and fast rule. Factors such as your. Car insurance for new drivers can be expensive. For the youngest new drivers between the ages of , annual insurance premiums average around £1, and. Minimum coverage, on the other hand, has an average annual cost of $ However, car insurance is like a fingerprint: although your circumstances may seem. age, occupation, income, principal place of garaging, education, home If your insurance company increases your auto insurance premium because of. The table below shows car insurance rates by age as a chart, and shows the the average annual rates for male and female drivers across a range of ages. Erie has the lowest sample annual rates for year-old female ($3,) and male ($4,) drivers in our analysis. Those numbers are 54% below the national. Ages 70 to Once drivers hit their mids, car insurance rates typically go up, as this age bracket has an increased risk of being in an accident. Older. Your age may also impact your car insurance premium. Younger, less experienced drivers often pay more for car insurance than older drivers. The coverages. Age is by far the most significant factor in your insurance premiums. Younger drivers, especially those under the age of 25, often face higher insurance. Another myth is that older drivers always pay less for insurance. While age can lead to lower rates, this isn't a hard and fast rule. Factors such as your. Car insurance for new drivers can be expensive. For the youngest new drivers between the ages of , annual insurance premiums average around £1, and. Minimum coverage, on the other hand, has an average annual cost of $ However, car insurance is like a fingerprint: although your circumstances may seem. age, occupation, income, principal place of garaging, education, home If your insurance company increases your auto insurance premium because of. The table below shows car insurance rates by age as a chart, and shows the the average annual rates for male and female drivers across a range of ages. Erie has the lowest sample annual rates for year-old female ($3,) and male ($4,) drivers in our analysis. Those numbers are 54% below the national. Ages 70 to Once drivers hit their mids, car insurance rates typically go up, as this age bracket has an increased risk of being in an accident. Older. Your age may also impact your car insurance premium. Younger, less experienced drivers often pay more for car insurance than older drivers. The coverages. Age is by far the most significant factor in your insurance premiums. Younger drivers, especially those under the age of 25, often face higher insurance.

The cost of car insurance varies depending on several factors, including your driving record, age, gender, and more. According to countrywide data from Progressive, the cost of auto insurance in most states for seniors tends to start rising at the age of In contrast. on average, on their annual premium when they switched to AAA Car Insurance and saved1 Certain factors affect your car insurance premium like age, driving. The Maryland Insurance Administration (MIA) frequently hears from consumers that they feel their auto insurance rates increase at every renewal, even if they. Across all age groups, the average U.S. driver paid $1, for car insurance in , according to an analysis of 83 million rates by The Zebra, an insurance. Average car insurance rates by age group range from $ per year for year-old drivers to $3, per year for drivers who are 16 years old. Compare car insurance rates for + car models from every major car brand from Acura to Volvo and learn what you can expect to pay in These cost estimates are based on a full coverage policy for a driver under 65 years of age with more than six years of driving experience, no record of. Average car insurance by age ; , $2,, $ ; , $1,, $ ; , $1,, $ ; 70+, $1,, $ Drivers in different age groups pose different risks, which is why rates tend to differ based on how old the insurance policy holder is. 3. Your location. (age, driving record, car model, etc.). On average, Nova Scotia drivers can expect to pay around $ per year for car insurance, up from $ annually just. cost to insure your car. The good news is, safe driving and lots of experience can help to lower your premiums. Cost insurance - experience. Experience. You. Auto Insurance · Your driving record – The better your record, the lower your premium. · Your age – In general, mature drivers have fewer accidents than less. California's Low Cost Automobile (CLCA) Insurance program was established by The annual premiums in California vary by county, ranging from $ - $ Teenage car insurance average cost per month and per year · According to detalugi.ru's data analysis, the average annual cost of car insurance for a teenage. car compare insurance I can't imagine what a new car must cost. This annual with an accident but after the accident was forgiven, semi. Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. Click on any of them to see more detail on how age, location and driving record can impact these rates. Acura Model, Annual Insurance Rate, Monthly Insurance. Companies can use your age, credit history, education, gender, marital status, employment status and occupation as rate factors. Why does auto insurance cost so. The average cost to add a year-old, newly licensed driver to an adult's existing auto insurance policy is about $ per month.

List Of High Yield Savings Accounts

A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Choose between our federally-insured savings accounts with better dividend rates, easy access, and few and lower fees As High As. % APY. Kickstart. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Earn % APY with M1's FDIC-insured High-Yield Savings Account. Start saving smarter today and secure up to $5M in coverage. Get started with our basic savings account and earn a market-leading rate of % APY. Plus, you'll have the flexibility to withdraw what you need—anytime. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial stability. Start your journey to. My Banking Direct High Yield Savings · Varo Savings Account · UFB Direct High Yield Savings · EverBank Performance Savings · Laurel Road High Yield Savings · Bask. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Choose between our federally-insured savings accounts with better dividend rates, easy access, and few and lower fees As High As. % APY. Kickstart. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Earn % APY with M1's FDIC-insured High-Yield Savings Account. Start saving smarter today and secure up to $5M in coverage. Get started with our basic savings account and earn a market-leading rate of % APY. Plus, you'll have the flexibility to withdraw what you need—anytime. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial stability. Start your journey to. My Banking Direct High Yield Savings · Varo Savings Account · UFB Direct High Yield Savings · EverBank Performance Savings · Laurel Road High Yield Savings · Bask. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today.

See Your Deposit Account Agreement for a full list of options. On-the-go Yield (APY) disclosed. Interest will be compounded daily and credited to. Savings) defines annual percentage yield. (APY) as a percentage rate deposit in, a new account; and (2) For purposes of §(a) formerly §(a). Marcus by Goldman Sachs is a great choice for people looking for a top notch high yield savings account. With consistently high interest rates, no fees, and no. Money Markets, IRA, Health Savings Accounts, and the list goes on and on. Put your money into a higher yielding certificate account. Your money is safe. Boost your savings with an online high-yield savings account (HYSA). Take advantage of today's rates and earn % APY on your entire account balance. You may also obtain current rate information by calling the Credit Union or visiting our website. 3. Minimum Balance Requirements: We list the minimum balance. List of rare fees. Banking should be easy. Zelle, Apple Pay, Google Pay High Yield Savings Account – $ to open account. Rates may change without. Compare the Best High-Yield Savings Accounts ; up to %² APY: SoFi Checking and Savings ; % APY: American Express® High Yield Savings ; % APY: Capital. We have compiled a list of frequently asked questions regarding High Yield Savings Accounts that may be helpful. The term “high yield savings account” refers to a savings account that offers a higher annual percentage yield or interest and that interest may be calculated. Here's a short list of good online banks with >5% APY. There are others, this is just my short list. western alliance cit sofi jenius. Boost your savings with an online high-yield savings account (HYSA). Take advantage of today's rates and earn % APY on your entire account balance. Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings · CIT. July 17, Removed American Express from the list of best online savings accounts. Added Synchrony Bank. June 7, Removed Ally, Bread Savings, Newtek. Earn more interest with a high yield savings account · High-Rate Savings Account Features · Bank on your terms with Alliant's high interest online savings account. Best high-yield savings account rates of September ; BrioDirect. High-Yield Savings · % ; Jenius Bank. Jenius Savings Account · % ; Capital One. Best high-interest savings account rates in Canada ; Scotiabank MomentumPlus Savings Account, Up to % for the first 3 months (Regular rate of %, plus up. Synchrony High Yield Savings. Synchrony Bank has one of the better savings accounts available today. Its central feature is a % APY, which is one of the. High Yield Savings Account · % APY · Expect more from your savings account. · Open a Direct Checking Account · Privacy Preference Center. High-interest savings accounts can help you earn more money simply and consistently. Find out how BMO can help you build your savings faster.

How Much Is Liability Insurance For Personal Trainers

A solution can be to protect yourself with personal trainer insurance, from Hiscox. In some cases, it is recommended that personal trainers carry professional. And many more. Our fitness liability insurance programs are also designed to integrate virtual training insurance coverages for fitness instructors and coaches. Monthly personal trainer insurance costs $15 a month, or you can save 13% by switching to an annual policy for just $ a year. Personal trainer insurance starts at $ annually. Inquire to learn more, get a more precise quote, and sign up today. Gymnastics Liability Insurance Coverage. LIABILITY INSURANCE. GET PROFESSIONAL AND GENERAL LIABILITY COVERAGE FOR AS LITTLE AS $11/MONTH. As a newly Certified Personal Trainer it's important to insure. Wellness and fitness insurance is a type of professional liability insurance that helps protect professionals like personal trainers and yoga instructors. At $ per year, personal trainer liability insurance through Insure Fitness is nearly 20% cheaper than the average cost of personal trainer insurance. Personal trainer insurance is coverage customized to meet your personal training business needs. Personal trainer insurance coverage can help protect you from. How much is personal trainer General Liability insurance? General liability insurance costs 99% of our customers $15 on average per month. It can help to. A solution can be to protect yourself with personal trainer insurance, from Hiscox. In some cases, it is recommended that personal trainers carry professional. And many more. Our fitness liability insurance programs are also designed to integrate virtual training insurance coverages for fitness instructors and coaches. Monthly personal trainer insurance costs $15 a month, or you can save 13% by switching to an annual policy for just $ a year. Personal trainer insurance starts at $ annually. Inquire to learn more, get a more precise quote, and sign up today. Gymnastics Liability Insurance Coverage. LIABILITY INSURANCE. GET PROFESSIONAL AND GENERAL LIABILITY COVERAGE FOR AS LITTLE AS $11/MONTH. As a newly Certified Personal Trainer it's important to insure. Wellness and fitness insurance is a type of professional liability insurance that helps protect professionals like personal trainers and yoga instructors. At $ per year, personal trainer liability insurance through Insure Fitness is nearly 20% cheaper than the average cost of personal trainer insurance. Personal trainer insurance is coverage customized to meet your personal training business needs. Personal trainer insurance coverage can help protect you from. How much is personal trainer General Liability insurance? General liability insurance costs 99% of our customers $15 on average per month. It can help to.

Professional liability insurance covers your personal trainer or fitness instructor business if you're sued for performing professional services. Protect your business with Hiscox's fitness liability insurance for as low as $/mo. With our insurance for fitness professionals, your small business. Basic protection from everyday accidents starts at $25 monthly and offers up to $10, coverage. Professional liability insurance costs as little as $11 a. As a certified personal trainer, it is vital to protect your fitness career against potential liability issues in case a client gets injured during the. General liability insurance covers a wide range of personal trainer accidents and basic risks. You'll have financial protection if someone gets hurt in a. Professional liability insurance costs personal trainers less than $35 per month. Several factors will have an impact on personal trainer insurance costs. What Type of Insurance Should a Personal Trainer Have? · General liability insurance helps protect your business from claims of bodily injuries, property damage. Personal trainer insurance protects against claims arising from your business services. Tailor your coverage & insure your business for as low as $20/month. Liability fitness insurance protects you if a lawsuit is brought against you for negligent practices. The purpose of a waiver is to warn the client of possible. Professional liability insurance for personal trainers is a way to help you protect yourself. What we offer. Markel has 40 years of experience. With Insure Fitness Group, personal trainers can get comprehensive coverage for only $ per year, which breaks down to a cost of only $ per day. The cost of personal trainer liability insurance typically starts at about $ a year. The final cost depends on a number of factors. Our personal trainer liability insurance costs start at $ per year or just $ per month. Since the average annual cost of personal trainer liability. Receive an instant quote & apply online for A++ Personal Trainer Insurance. Rates start at less than $/year, and proof of insurance is issued. Pay as low as $ for a rock-solid $1,, Liability Limit that does not require you to join another expensive association and receive your Certificates of. For ACE professionals, policies start at $ for one year and $ for two years. The coverage is relatively comprehensive for the price: You'll get the. Liability insurance protects you and safeguards your personal training business if something should go wrong. The majority of personal trainers never encounter. Many clubs won't permit independent contractors on site without evidence of liability insurance. Upon enrollment, you'll receive a fitness instructor insurance. Insure Fitness Group offers the most comprehensive personal trainer instructor insurance in the industry. We cover thousands of fitness professionals with "A". Our CPT ProPlan has an annual premium of $, and our CPT Premiere ProPlan has an annual premium of $ Additional coverage costs $25 and requires you to.